What is Integrated Financial Planning and Why is it Important?

Jim’s dilemma Jim, a CFO of a rapidly expanding tech enterprise, often found himself caught in the whirlwind of numbers, projections, and strategies. As he navigated through the maze of financial data in 2023, he constantly grappled with the fragmentation inherent in the Finance, Planning, and Accounting departments. While Finance struggled to forecast accurately, relying on historical data that often did not capture the dynamism of the tech industry, the Planning team frequently conceived strategies based on ambitious market trends, sometimes bypassing the practical constraints of the company’s actual fiscal health. Meanwhile, amidst the diligent efforts of the Accounting department to balance the books, there were instances where they operated in a retrospective bubble, seemingly oblivious to forward-looking strategies. This disjointed symphony, as a consequence, not only gave rise to internal discord and inefficiencies but also left the company vulnerable to unseen market risks. Jim, with a keen foresight into the potential ramifications, could envision a cascade of negative outcomes: missed opportunities, squandered resources, and a misalignment of goals that could send ripples across the entire enterprise. Without the implementation of an integrated financial planning approach, it seemed as though each unit marched to the beat of its own drum. This disjointed state of operations emerged as a formidable barrier to the company’s aspirations, leaving Jim burdened with the task of bridging these isolated islands of information. Thus, Jim embarked on his mission, meticulously outlining the areas that required attention for improvement within his company. He recognized the imperative need for Integrated Financial Planning to orchestrate a cohesive and efficient framework. What is Integrated Financial Planning? Integrated financial planning (IFP) delineates a comprehensive and, importantly, collaborative approach that intricately intertwines various business functions and processes. In stark contrast to traditional financial planning operating in silos, IFP emphasizes holistic synchronization, thereby offering a unified vision of the company’s financial future. Consequently, this approach fosters a seamless integration of diverse aspects, ensuring a cohesive and strategically aligned framework for the organization. Key Aspects and Features of Integrated Financial Planning Collaborative Framework: IFP cultivates a collaborative culture by actively engaging departmental heads and stakeholders in the planning process. Consequently, this alignment ensures that individual departmental strategies harmonize with the company’s fiscal goals, fostering mutual understanding and a collective sense of purpose. Real-time Data Integration: Integral to IFP is the assimilation of current, relevant data from diverse business operations. Leveraging advanced financial systems and tools facilitates continuous updating and recalibration of financial plans in response to market dynamics, economic shifts, and internal operational changes. Scalable Model: Designed with scalability in mind, integrated financial planning adapts to a company’s growth. As the company expands, the IFP model ensures a cohesive and robust financial strategy, regardless of operational scale. Reduction of Redundancies: IFP identifies and eliminates operational redundancies by providing a unified fiscal roadmap. This prevents overlapping efforts and resources, leading to cost savings and streamlined processes. Enhanced Communication: IFP is fundamentally centered on fostering clear and transparent communication of financial strategies and objectives within the organization. Additionally, through the implementation of standardized terminologies, financial dashboards, and regular fiscal reviews, it guarantees that every stakeholder not only comprehends but is actively engaged in understanding and contributing to their pivotal role in the company’s financial trajectory. Furthermore, by consistently employing these tools, IFP facilitates a seamless and coherent alignment of all stakeholders with the overarching financial goals, thereby enhancing the overall effectiveness of the organizational financial strategy. Accountability Mechanism: By its nature, integrated planning inherently fosters a higher degree of accountability. Through the collaborative nature of IFP, departments collectively take responsibility for the financial plan’s success, being instrumental in its formation. Enhanced Communication: One of the cornerstones of IFP lies in clear and transparent communication of financial strategies across the organization. By utilizing standardized terminologies, financial dashboards, and regular fiscal reviews, it ensures that every stakeholder comprehends their role in the company’s financial trajectory. Risk Management: Offering a comprehensive view of the company’s financial landscape, IFP facilitates early risk identification and mitigation. Through an integrated approach, potential risks stemming from market fluctuations, internal inefficiencies, or external economic factors are proactively addressed. Impact, Risks, and Challenges of Not Having an Integrated Financial Planning Framework and Strategy Area Impact Risks Challenges Inefficient Resource Allocation Resources, both in terms of manpower and capital, may be allocated to projects or departments without a clear understanding of the overarching financial objectives. Misallocated resources can lead to underfunded crucial projects or overspending on less critical tasks. Reallocating resources mid-course can be disruptive and costly. Misaligned Organizational Goals Without a cohesive financial strategy, different departments might pursue conflicting objectives. Such conflicts can hinder the overall growth of the organization and even pit teams against each other. Realigning departmental goals to the company’s objectives can be time-consuming and may require significant shifts in strategy. Inaccurate Financial Forecasting Relying on isolated data can lead to financial forecasts that do not accurately reflect market realities or the company’s potential. Inaccurate forecasting can result in missed opportunities or ill-preparedness for market downturns. Constantly revising forecasts can destabilize operational planning and undermine confidence in financial leadership. Limited Forward-Looking Strategies A lack of integration often results in a retrospective focus, with limited foresight into future potentials or risks. Being reactive rather than proactive can put the company at a competitive disadvantage. Pivoting to a forward-looking approach after a setback can be challenging and might involve significant operational upheavals. Reduced Inter-departmental Communication Departments may operate in silos, leading to reduced synergy and collaboration. Crucial information might not be shared in time, resulting in missed insights or duplicated efforts. Building bridges between departments after prolonged periods of isolation can be difficult, requiring efforts in team-building and communication strategies. Increased Exposure to Market Risks Without an integrated approach, the company might not have a holistic view of market trends and risks This can lead to ill-timed investments, lack of preparedness for market downturns, or missed growth opportunities Reacting to market changes without prior preparation can be more costly and less effective than

What Is a Financial Report Audit & How to Prepare for One

Breeze through your next Financial Reporting Audit When it comes to understanding the financial health of a business, financial reports are invaluable. However, it’s important that these reports are accurate and present a true picture of the business’s financial status. This is where a financial report audit comes in. Let’s delve into what this entails and how businesses can effectively prepare for one. What is a Financial Report Audit? A financial report audit is a detailed examination of a company’s financial statements and related operations to ensure accuracy and compliance with accounting standards and regulations. Certified public accountants or audit firms typically conduct these independent evaluations. The main goal of such audits is to provide assurance that the financial statements fairly represent the company’s financial position, results of operations, and cash flows in accordance with generally accepted accounting principles (GAAP). Why is a Financial Report Audit performed and why is it Important? Credibility: One of the primary reasons companies undergo financial audits is to provide credibility to their financial statements. Shareholders, investors, banks, and other stakeholders want assurance that the financial information presented is accurate and unbiased. Regulatory Requirement: For many businesses, especially public companies, financial audits are mandatory, ensuring compliance with various regulatory bodies. Risk Management: An audit identifies weaknesses in internal controls and provides recommendations to strengthen them. This helps prevent fraud and other financial mismanagement. Decision Making: Accurate financial statements are crucial for management to make informed business decisions. What’s the Difference Between Accounting and Auditing? Accounting is the process of recording, summarizing, analyzing, and reporting financial transactions of a business. Accountants prepare financial statements based on the recorded transactions. Auditing, on the other hand, is the process of examining these financial statements and the processes around them to ensure accuracy, compliance, and that they represent a true and fair view of the business. In simple terms, accounting involves creating the statements, while auditing evaluates them. What is Reviewed During a Financial Report Audit? During a financial report audit, the auditor will review various elements, including: Balance Sheet Items: This includes assets, liabilities, and equity accounts. Income Statement Items: Revenues, expenses, gains, and losses are assessed. Statement of Cash Flows: This details the inflow and outflow of cash from operations, investments, and financing. Internal Controls: The processes and systems in place to safeguard assets and ensure accurate financial reporting are examined. Reconciliation: Comparing different sets of data, such as bank statements with book records, to ensure they are consistent. Footnotes: These provide additional information and clarity about the financial statements and are thus crucial to understanding them fully. What’s the Difference Between an Audit, a Review, and a Compilation? Audit: As discussed, an audit provides the highest level of assurance. Auditors express an opinion on the financial statements’ fairness and accuracy. Review: This is less intensive than an audit. It involves analytical procedures and inquiries to provide a limited assurance that no material modifications are necessary for the financial statements to be in conformity with GAAP. Compilation: This is the least intensive of the three. Accountants assist in presenting financial information in the form of financial statements without providing any assurance on them. List of What to Prepare During a Financial Report Audit Preparing for a financial report audit can be streamlined by ensuring the following: Documentation: Have all your financial statements, ledgers, and journals readily available. Reconciliation Statements: Ensure that all reconciliations, such as bank and inventory, are up-to-date. Internal Control Procedures: Document all your processes, especially those related to financial reporting. Access: Ensure that the auditors have access to all necessary software, systems, and facilities. Supporting Evidence: Keep contracts, invoices, SOP’s, regulatory guidelines, manuals, bylaws and other supporting documents organized and accessible. Communicate: Ensure your finance and accounts team is available to answer any queries the auditors might have. Previous Audit Findings: If you’ve had prior audits, have the findings and your responses ready. Your Next Steps…. 💡Click here to reduce time spent on period-end reporting 🔋Click here if you wish to solve 25+ Spreadsheet reporting issues 🔆 Click here to improve the accuracy and usability of generated reports 💯 Click here to decrease risk by providing on-demand access to the transaction detail behind every reported balance ☎️ Book a free, no-obligation walkthrough with Mondial to see how we can help you in financial reporting and consolidations just like one of our successful clients.

Solving the Multi-GAAP Nightmare of International Financial Reporting

Navigating the “Labyrinth” of International Financial Reporting Financial reporting is continually evolving, and with it comes the challenge of navigating various accounting standards and frameworks. For multinational corporations, the need to comply with multi-GAAP (Generally Accepted Accounting Principles) can offer real challenges. Coping in a timely fashion with the complexities of multiple, different accounting standards can often lead to confusion, generate inefficiencies, and risk creating compliance issues. What is GAAP? GAAP stands for “Generally Accepted Accounting Principles.” It is a set of accounting standards, principles, and procedures that govern how financial statements are prepared and presented in the United States. GAAP accounting provides a standardized framework for organizations to record, report, and communicate their financial information to external stakeholders, such as investors, creditors, regulators, and the general public. GAAP stands for transparency and clarity. Understanding Multi-GAAP: Multi-GAAP refers to the need for companies to adhere to different accounting principles based on the countries in which they operate or report financial statements. These varying standards, such as IFRS (International Financial Reporting Standards), US-GAAP (Generally Accepted Accounting Principles specific to the United States), and other individual country standards, introduce differences across financial reporting requirements. As companies expand globally, the complexity of managing financial information – such as treatment of assets, liabilities, and transactions -in compliance with multiple standards becomes increasingly burdensome. An accounting system that must follow up GAAP and at the same time has multi-country or group reports is the perfect candidate for this. The “Labyrinth” of International Financial Reporting Nickname: The term “Labyrinth” Financial Reporting humorously symbolizes the difficulties companies face while trying to address multi-GAAP requirements. Like someone scurrying through a maze, navigating through different accounting standards can be just as challenging and disorienting. The analogy captures the essence of the multi-GAAP nightmare, where companies may find themselves lost in a maze of rules and interpretations. This is most true for an accounting system that must follow GAAP. 3 Major Challenges of Multi-GAAP: 1. Complexity: Multi-GAAP compliance demands meticulous attention to detail, as every accounting treatment must align with each standard’s specific requirements. This complexity increases exponentially with the number of countries a company operates in. The complexity of multi-GAAP compliance is a formidable challenge that companies face when operating in multiple countries. Even where countries have adopted the supposedly standard IFRS, many countries continue to have their own local interpretations of accounting standards and ensuring that financial information aligns with each specific requirement is no small task. As the number of countries in which a company operates increases, so does the intricacy of managing different accounting principles simultaneously. Below are some examples to illustrate the challenges involved: Varying Recognition and Measurement Criteria: One of the primary complexities in multi-GAAP compliance lies in the differing recognition and measurement criteria for similar transactions or events. For instance, revenue recognition – the timing of when a company recognizes the revenue on a sale – may vary between IFRS and local GAAP accounting. This may be in addition to different subjective interpretations that different accountants may choose to adopt depending on the risk profile of individual organizations. Under IFRS for example, revenue recognition might be based on the transfer of risks and rewards, whereas US-GAAP could follow a more specific five-step model. Companies must first interpret, then adopt a consistent approach, and finally carefully analyze each transaction to apply the selected principles and avoid discrepancies. Valuation of Assets and Liabilities: Valuing assets and liabilities can differ significantly across various standards. For example, the impairment testing for long-lived assets like property, plant, and equipment may follow different approaches under IFRS and local GAAP accounting. Additionally, the treatment of intangible assets such as goodwill may vary considerably, leading to divergent financial results under different standards. This challenges what is GAAP all about and how it impacts financial reporting. Currency Translation: Operating in multiple countries involves dealing with multiple currencies, which introduces complexities in currency translation. Companies must consolidate financial statements from subsidiaries using a common currency for reporting purposes, which can lead to translation differences due to both fluctuations in exchange rates, and also the rates used to translate different types of accounts during the consolidation process. Disclosure Requirements: Another challenge arises from the varying disclosure requirements of different standards. Each standard may demand specific information in financial statements and footnotes, making it essential for companies to comply with each standard’s disclosure requirements accurately. 2. Time Consumption: Preparing financial statements under multiple standards can be time-consuming, affecting the timely delivery of information to stakeholders. Time consumption is a critical issue faced by companies operating in multiple countries as they strive to prepare financial statements under different standards. The need to adhere to various accounting principles for each region can lead to delays in financial reporting, affecting the timely delivery of vital information to stakeholders. Let’s explore this challenge further and provide examples to illustrate the impact of time consumption on financial reporting: Understanding and Applying Different Standards: Each local-GAAP has its own unique set of rules, principles, and guidelines. Finance and accounting teams must invest significant time and effort in understanding and applying these varying standards to ensure accurate financial reporting. This can be especially time-consuming for companies that operate in countries with drastically different accounting frameworks Data Collection and Aggregation: Preparing consolidated financial statements often starts with collecting financial data from various subsidiaries and business units. Gathering this data from diverse sources can be a time-consuming and resource-intensive process in its own right; but can become downright complex when local accounts are prepared to different accounting standards or recorded in different local currencies. Manual Adjustments and Reconciliations: Aligning financial information to different standards in GAAP accounting may require manual adjustments and reconciliations. Companies must ensure that their financial data is accurately converted and presented in accordance with each accounting standard, leading to additional time and effort. Review and Approval Process: The process of reviewing and approving financial statements prepared under multiple standards can be lengthy, involving multiple

AI in Financial Reporting: “Not quite there yet”

AI: Are we there yet? Artificial Intelligence (AI) has been hailed as a panacea for various industries, promising revolutionary advancements in efficiency and accuracy. One area that has attracted considerable attention is financial reporting. Proponents of AI in finance argue that it can automate mundane tasks, detect fraud, and provide real-time insights. Despite AI hype, skeptics doubt its current capacity to revolutionize financial reporting. This article discusses limitations, challenges hindering mass AI adoption, yet anticipates a bright future in this critical domain. Data Quality and Reliability One major stumbling block for AI in financial reporting lies in the quality and reliability of the underlying data. AI algorithms heavily rely on vast amounts of accurate and consistent data to generate meaningful insights. In the realm of finance, data integrity is paramount. Complex, unstructured financial data poses challenges for accurate interpretation by AI systems. Minor discrepancies can heavily impact AI outputs, causing flawed financial reports and unreliable insights. Interpretation and Contextual Understanding AI systems excel at pattern recognition and statistical analysis, but they often struggle with contextual understanding and interpretation. Financial reporting requires a deep understanding of complex accounting principles, industry-specific regulations, and nuanced financial analysis. AI’s rapid data processing contrasts its inability to understand financial context, limiting accurate and insightful reports. Human expertise and judgment are still necessary to ensure proper interpretation and application of financial data. Lack of Accountability and Responsibility When it comes to financial reporting, accountability and responsibility are critical. However, AI algorithms often operate as black boxes, making it challenging to trace the decision-making process and assign accountability. AI-generated reports lacking transparency may evoke mistrust and raise regulatory concerns. Stakeholders, including auditors and regulators, require a clear understanding of the methodologies employed by AI systems, which currently remain elusive. Regulatory Compliance and Ethical Concerns Adhering to regulations and ethics maintains transparency and trust in financial reporting. However, AI’s lack of ethical reasoning and potential biases pose significant risks. Biased or non-diverse training data can skew outcomes in AI-generated reports. Lack of specific AI regulations in financial reporting heightens concerns, allowing potential misuse. Adaptability and Flexibility Financial reporting requirements evolve continuously, driven by changing regulations and industry practices. AI systems, on the other hand, often struggle with adaptability and flexibility. They are typically trained on historical data and struggle to incorporate new rules or regulations without extensive retraining. This lack of agility makes AI ill-suited to keep pace with the dynamic nature of financial reporting. Human professionals, with their ability to adapt and learn, continue to play a vital role in navigating complex reporting requirements. The Case for AI: Challenges of Financial Reporting in the last 20 years Despite challenges, considering global commerce changes, AI’s future role in efficient financial reporting seems promising. In the last two decades, global producers aimed for efficiency via just-in-time production and cost-effective labor markets. This approach has had a significant impact on global supply chains. Traditional suppliers adapted by establishing distributed operations near customers, creating or acquiring local subsidiaries. As a result, organizational structures have become more complex, especially for small- and medium-sized businesses (SMBs). Parent companies invested in systems managing global-scale distributed operations and remote administrative processes. These solutions streamline processes but lack comprehensive financial management for complex global reporting compliance. Localized legacy systems lack global accounting functionality, hindering accurate reports for the parent organization. Struggling with evolving local requirements, systems heavily rely on manual processes and spreadsheets. Limitations cause delays in critical information delivery, increasing decision-making risks for global companies. Where we are right now? Cloud tech offers a chance to build reliable global financial reporting using validated data from existing ERP systems. These solutions consolidate diverse system data unlike traditional ERP vendors and systems. Crucially, no modifications to source systems protect significant ERP investments at each customer facility. The foundation for useful AI Intuitive accounting hubs foster an environment for AI to offer substantial value. Systems aggregate and map data to central templates, enhancing report quality and reliability for manual and AI-generated reports. Consistent data aids meaningful interpretation, offering contextual understanding through a level reporting field. Transaction-level data offers complete auditability, enhancing accountability and facilitating clearer responsibility allocation. Detail-rich data lays a strong foundation for ESG reporting, potentially leveraging AI for added value. The “bridge” before we go Full AI Human expertise remains crucial for accurate, reliable, and ethical financial reporting. AI in financial reporting necessitates human input for usefulness and likely to support initial analysis, necessitating human review. With increasing user experience, reliance on AI for ‘correct’ data and reduced need for interpretation is anticipated. The future will reveal AI’s capacity to adapt to changes and deliver high-quality output independently. Your Next Steps…. 💡Click here to reduce time spent on period-end reporting 🔋Click here if you wish to solve 25+ Spreadsheet reporting issues 🔆 Click here to improve the accuracy and usability of generated reports 💯 Click here to decrease risk by providing on-demand access to the transaction detail behind every reported balance ☎️ Book a free, no-obligation walkthrough with Mondial to see how we can help you in financial reporting and consolidations just like one of our successful clients.

Mondial/aclaros enrich Financial Reporting in Mid-Market ERP

Accelerate Financial Reporting for Mid Markets BEDFORD, New Hampshire, June 15, 2023. Mondial Software and Aclaros partnered to advance financial reporting for mid-market companies, including SAP Business One users. The collaboration supports Mondial’s global financial reporting platform for multinational companies requiring unified management, group, and statutory reporting. The Partnership Value “Mondial’s product offers great value for companies who need consolidations and complex financial reporting”, said L. Bertus Jacobs, Managing Partner of aclaros. “Mondial meets the needs of businesses operating multiple entities or in multiple countries who need consolidated financials. It integrates seamlessly with SAP Business One and various ERPs, easing multi-currency conversion and spreadsheet consolidation.”” “We’re delighted to be partnering with Aclaros, an SAP Platinum Partner and one of the leading SAP Business One Partners serving small and mid-sized businesses globally”, said Mondial’s CEO Mark Richardson. “Aclaros has a long track-record working with organizations to help them implement and get the most out of their ERP solutions – wherever they do business. Their understanding of the complex financial reporting and compliance needs of global companies makes them an excellent match for our firm.” About Mondial Software Mondial Software is a global provider of cloud-based tools for multi-ERP financial reporting and consolidations. Founded by experienced accounting professionals with global ERP backgrounds, Mondial serves a worldwide customer base. For more information, visit http://www.https://mondialsoftware.com. About aclaros Aclaros is a leading systems integration and management consulting company with offices in Canada, the United States. Its experienced team enables customers to realize their vision by leveraging the world’s leading on-premises and cloud-based business applications. It specializes in various SAP Business One versions and modules, serving diverse industries like distribution, manufacturing, retail, and services. Aclaros is a member of the United Vars alliance and an SAP Platinum Partner. For more information, visit https://aclaros.com/. Your next steps… 💡Click here to reduce time spent on period-end reporting 🔋Click here if you wish to solve 25+ Spreadsheet reporting issues 🔆 Click here to improve the accuracy and usability of generated reports 💯 Click here to decrease risk by providing on-demand access to the transaction detail behind every reported balance ☎️ Book a free, no-obligation walkthrough with Mondial to see how we can help you in financial reporting and consolidations just like one of our successful clients.

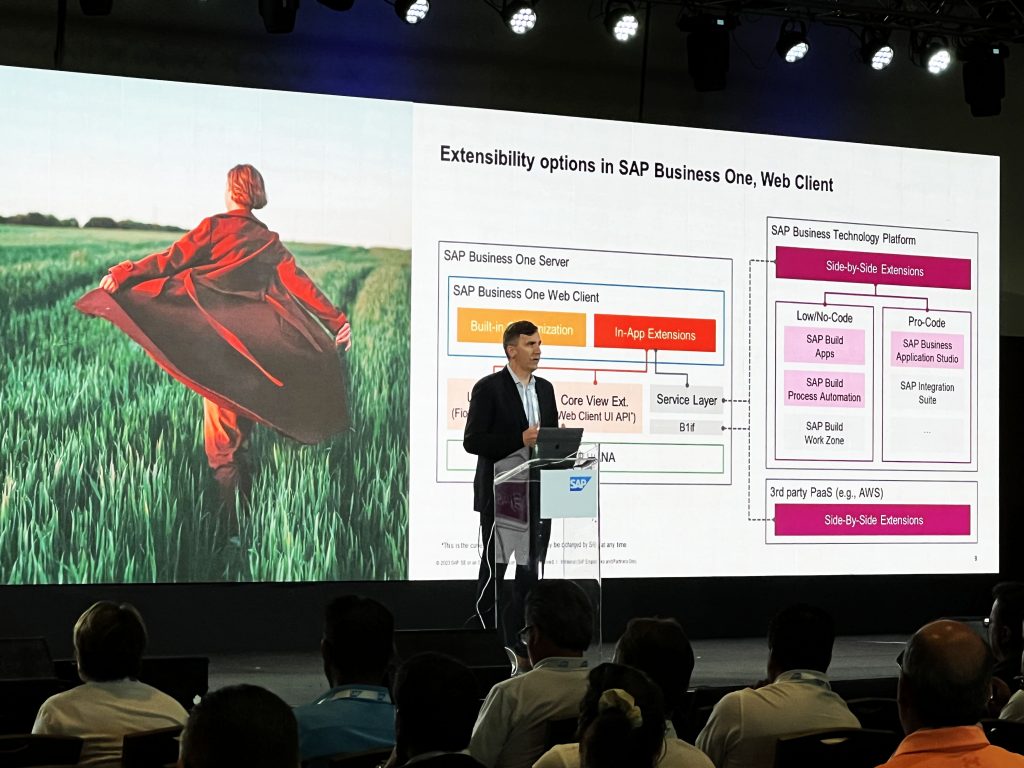

Takeaways SAP Partner Summit for Small to Midsize Enterprise

Key Takeaways and Learnings: Mondial Software participated in the recent 2023 SAP Partner Partner Summit for Small to Mid-Sized Enterprise (SME). At the event, we engaged with SAP, learning their vision, and shared Mondial’s developments.” In 2023, SAP Partner Summit was esteemed, a must-attend for SAP’s SME-focused partners delivering solutions. The summit delved into SAP S/4 HANA Public Cloud, Business One, and Business ByDesign advancements. Furthermore, it facilitated discussions on harnessing the power of the SAP Business Technology Platform to accelerate cloud innovations. The SAP Partner Summit provided Mondial with several key takeaways and learnings: Continuous Innovation: To thrive in a rapidly evolving business landscape, businesses must embrace a culture of continuous innovation. SAP’s solutions offer the necessary tools and platforms to foster innovation and drive growth. Cloud Adoption: The cloud has become an essential enabler for businesses seeking scalability, agility, and cost-efficiency. Utilizing SAP S/4 HANA Public Cloud and Business One empowers Mondial’s clients with real-time insights for efficiency. Collaboration and Networking: At the summit, emphasis on collaboration within the SAP ecosystem fosters innovation and valuable partnerships for SAP B1 users. Customer-Centric Approach: SAP’s focus on tailoring the summit agenda to each role underscores the importance of a customer-centric approach. Mondial aligns solutions to meet unique client needs, ensuring success and satisfaction. Relevance Through active participation in the SAP Partner Summit, Mondial and other partners stayed updated on trends, enhancing expertise. This allowed us to showcase our integrated solutions within the SAP B1 environment. Additionally, the event served as a collaborative platform, fostering interactions, networking, and strengthening partnerships within the SAP ecosystem. Moreover, SAP’s commitment to SAP Business One as a primary web client aligns with Mondial’s vision. With the ability to launch Mondial directly from the SAP Business One Web Client, seamless integration with various ERP products, both SAP and non-SAP, is now feasible. Moving forwards: The SME SAP Partner Summit transformed Mondial Software and other businesses toward growth, innovation, and sustainability. Summit participation granted Mondial insights into ERP advancements, cloud innovations, and SAP’s future vision. The event affirmed our dedication to enabling businesses with 100x faster, accurate financial reporting and consolidation. Your next steps 💡Click here to reduce time spent on period-end reporting 🔋Click here if you wish to solve 25+ Spreadsheet reporting issues 🔆 Click here to improve the accuracy and usability of generated reports 💯 Click here to decrease risk by providing on-demand access to the transaction detail behind every reported balance ☎️ Book a free, no-obligation walkthrough with Mondial to see how we can help you in financial reporting and consolidations just like one of our successful clients.

How to Fix Common Charts of Accounts Challenges in Financial Reporting

The Charts of Accounts Mystery. The charts of accounts (COA) is a fundamental tool used in financial reporting, additionally serving as a vital component of an organization’s accounting system. It provides the necessary structure and organization for the systematic classification and recording of financial transactions. In essence, the COA acts as a roadmap, guiding finance and accounting teams in categorizing and classifying these transactions into relevant accounts. This article gives us rundown on how to fix common charts of accounts challenges. Each account within the COA represents a unique element of an organization’s financial position, such as assets, liabilities, revenues, and expenses. By assigning specific codes or numbers to these accounts, the COA consequently enables the efficient tracking and analysis of financial data. It serves as a standardized framework that facilitates the preparation of financial statements, including the balance sheet, income statement, and cash flow statement. Your COA, why it’s important? The significance of the COA in financial reporting cannot be overstated. It provides a common language for finance professionals, also ensuring consistent and accurate recording and reporting of financial information. The COA facilitates the aggregation of financial data, enabling stakeholders to gain insights into an organization’s financial performance, make informed decisions, and comply with regulatory requirements. Furthermore, the COA allows for the customization and tailoring of financial reports to meet specific reporting needs. It enables the segmentation of financial information by departments, cost centers, geographical locations, or any other relevant categories, providing management with valuable insights for strategic decision-making. Oftentimes, Finance and Accounting Teams wrestle with the COA Despite its critical role, finance and accounting teams often encounter challenges when working with the COA. These challenges can arise from issues such as inconsistent account structures, insufficient granularity, complex account numbering schemes, inadequate account descriptions, and a lack of alignment with business operations. Addressing these challenges is essential to ensure accurate and reliable financial reporting. Above all, to streamline processes, and enhance the effectiveness of finance and accounting teams. Inconsistent account structure within the Chart of Accounts (COA) A common challenge in financial reporting is an inconsistent account structure within the charts of accounts (COA). This occurs when there is a lack of standardized organization, resulting in confusion and discrepancies when categorizing financial transactions. Inconsistent account structures can manifest in various ways, such as varying levels of account granularity, conflicting naming conventions, or different hierarchies across departments or business units. For example, imagine a multinational corporation with multiple subsidiaries and divisions. Each division may have developed its own account structure independently, resulting in differences in the numbering system, account descriptions, and hierarchical relationships. One division might categorize expenses by cost centers, while another division uses a different method based on product lines. All things considered, inconsistency creates challenges when trying to consolidate financial data, analyze trends, or compare performance across divisions. It leads to confusion, delays, and potential errors in financial reporting. Impact worth taking a look at… The impact of an inconsistent account structure can be significant. Albeit it hampers the ability to generate accurate and meaningful financial reports, as the data from different departments or divisions cannot be easily aggregated or compared. It makes it difficult to identify and track specific transactions or understand their context within the organization’s operations. Inconsistent account structures also increase the risk of misclassification and misinterpretation of financial data, potentially leading to errors in financial statements and regulatory compliance. How to Fix Inconsistent account structure within the charts of accounts (COA)? Start by conducting a comprehensive review of the COA’s structure and hierarchy. Engage key stakeholders, including finance, accounting, and operational teams, to ensure alignment with business operations. Establish clear guidelines for account numbering, naming conventions, and hierarchical structure. Regularly communicate and educate the finance team on the COA structure to maintain consistency. Implement periodic reviews and updates to accommodate any changes in the organization’s structure or reporting requirements after that. Lack of Detailed Granularity Insufficient detail within the charts of accounts (COA) can present significant challenges for finance and accounting teams when analyzing specific transactions and generating accurate financial reports. When the COA lacks the necessary granularity, it becomes difficult to gain meaningful insights from the financial data, hindering decision-making processes and compromising the reliability of financial reporting. Insufficient detail in the COA can manifest in various ways. For example, the COA may lack specific accounts to capture transaction details that are crucial for analysis or reporting purposes. This could include accounts for specific product lines, geographical regions, cost centers, or other relevant categories. Without these detailed accounts, it becomes challenging to track and analyze the financial performance of different segments of the business. Consider an example of a retail company with multiple store locations. If the COA does not include separate accounts for each store, the company would struggle to evaluate the individual financial performance of each location. This lack of granularity both would impede the identification of underperforming stores or the assessment of the impact of regional factors on profitability. Far reaching consequences The impact of insufficient detail within the COA can be far-reaching. It hampers the ability to perform in-depth analysis, hindering the identification of trends, patterns, and outliers within the financial data. This, in turn, limits the effectiveness of decision-making processes and may lead to missed opportunities or ineffective resource allocation. Additionally, it can result in the misrepresentation of financial information in reports, potentially leading to inaccuracies, misleading insights, and regulatory compliance issues. How to fix lack of detailed granularity in your COA? Analyze the reporting requirements and business operations to identify areas where additional granularity is needed. Collaborate with stakeholders to not only understand their information needs but also to incorporate those requirements into the COA. Consider expanding account codes to capture more specific transaction details. Regularly review and update the COA to ensure it aligns with evolving reporting needs and industry best practices. Overcomplicated Account Numbering Overcomplicated account numbering within the charts of accounts (COA) can significantly impede efficient financial reporting. This challenge arises when

Over-Reliance on IT a Key Risk in Supporting Financial Reporting?

Discover the potential risks and dangers of over-Reliance on IT in supporting financial reporting and accounting.

Mondial goes to the 2023 SAP Partner Summit for SME!

We’ll be in Vienna and Panama City Mondial will be in attendance at the 2023 SAP Partner Partner Summit for SME in both Panama City and Vienna to network with SAP Partners and spread the news about Mondial. The upcoming SAP Partner Summit for SMEs in 2023 is a highly recommended event for SAP’s esteemed partners. These are partners who specialize in offering SAP solutions to small and midsize businesses. This summit provides an excellent opportunity for partners to gain insights into the latest developments in SAP Business One and SAP Business ByDesign. Moreover, It also offers valuable information on leveraging the SAP Business Technology Platform to accelerate cloud innovations. In addition this summit showcases how to prioritize SAP S/4HANA Cloud in their cloud growth strategies. By attending the SAP Partner Summit, partners can stay up-to-date with the latest trends and best practices, expand their knowledge base, and enhance their ability to deliver exceptional solutions to their clients. SAP Partner Summit for SME is where we unveil our powerful yet affordable reporting solution Mondial works great for SAP Business One, ByDesign or S/4 HANA customers. When Industrial Battery Products (IBP) wanted timely, dependable financial reporting that would work seamlessly with SAP Business One, they turned to Mondial Software. Mondial is perfect for those enterprises with an ecosystem using multiple ERPs. Mondial also works well on those who have complex consolidations or financial reporting needs. Above all, Mondial can handle disparate charts of accounts, multiple currencies and even multiple year ends. Modern cloud technology with drill down to detailed line level transactions, automated eliminations, combined with a powerful yet simple report writer makes Mondial the ultimate tool for financial compliance reporting. Mondial is easy to use, affordable and powerful. SAP Partner Summit for SME May 23rd to 25th, 2023 in Panama This premier event will be held at the spectacular Panama Convention Center (PCC)/ This boasts the largest and most advanced technology among convention centers in the region. The Panama Convention Center (PCC) is conveniently located near several notable tourist attractions in Panama City. Visitors can explore the Panama Canal Museum and learn about the history and significance of the iconic waterway. Most importantly, for nature enthusiasts, the Metropolitan Natural Park is a great spot for hiking and birdwatching. The Biomuseo is also nearby, featuring fascinating exhibits on Panama’s biodiversity and ecology. Food lovers can enjoy the local cuisine and nightlife in the Casco Viejo district, a historic area filled with restaurants, bars, and shops. With so many things to see and do, attendees of the SAP Partner Summit for SMEs at the PCC can enjoy a well-rounded trip to Panama City. SAP Partner Summit for SME June 13th – 15th, 2023 in Vienna The Austria Center Vienna, the venue for the SAP Partner Summit for SME 2023, is located near many exciting tourist attractions. Attendees can take a stroll to the captivating historic old town, which is only a seven-minute ride away by underground. Incidentally, The city is also home to many world-famous landmarks such as St. Stephen’s Cathedral and the Schönbrunn Palace. Culture enthusiasts can visit the renowned Vienna State Opera or explore the impressive Museum of Fine Arts. For those who enjoy nature, the Donaupark offers a serene escape with lush greenery and stunning views of the Danube River. With so many options, attendees can make the most of their free time in Vienna during the SAP Partner Summit for SME 2023. Register and Meet us There at the Summit Register here for the Panama City Leg. Alternatively, you can also meet up with or our Head of Partnerships, Gary Feldman. Give him a call at +1-404-406-4276 or email at gary.feldman@https://mondialsoftware.com. Register here for the Vienna Leg. Likewise, you can also meet up with or our Chief Growth Officer Jurgen Dauk. Give him a call at +49-1511-6125-170 or email at jurgen.dauk@https://mondialsoftware.com.

Why Technical Professionals Struggle with People Skills?

Technical professionals often have specialized knowledge and use terminology that can be difficult for non-technical team members to understand. This can lead to miscommunication, misunderstandings, and a lack of clarity about project requirements, goals, and timelines.