Multi-Group Financial Reporting Mastery starts with Consolidated Financial Statements

Consolidated financial statements are essential for organizations with multiple subsidiaries or group entities. This comprehensive guide will walk you through the process of consolidating financial statements, covering key aspects such as intercompany transactions, subsidiary reporting, and group accounting policies. By following these steps, you’ll be able to create accurate and compliant consolidated financial reports that provide a holistic view of your organization’s financial health and effectively meet reporting needs.

What are Consolidated Financial Statements?

Definition of Consolidated Financial Statements

Consolidated financial statements are a set of financial reports that present the combined financial position and performance of a parent company and its subsidiaries as if they were a single economic entity. These statements aggregate the financial data from all entities within the group, eliminating intercompany transactions and balances to provide a clear picture of the group’s overall financial status.

Importance of Consolidated Financial Reporting

Consolidated financial reporting is crucial for several reasons:

- Provides a comprehensive view of the group’s financial health

- Enables stakeholders to assess the overall performance of the organization

- Facilitates better decision-making for management and investors

- Ensures compliance with accounting standards and regulatory requirements to enhance the effective financial performance of the organization.

- Improves transparency and accountability across the group

Key Components of Financial Statements

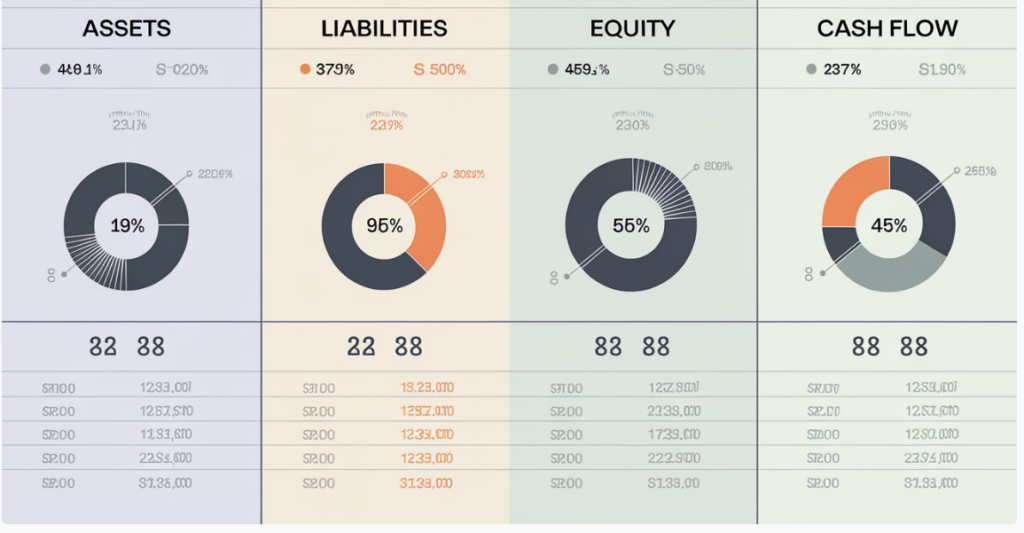

The main components of consolidated financial statements include:

- Consolidated Balance Sheet

- Consolidated Income Statement provides an accurate picture of the financial results of the group.

- Consolidated Statement of Cash Flows

- Consolidated Statement of Changes in Equity reflects the financial results of all legal entities within the group.

- Notes to the Consolidated Financial Statements

"The tapestry of corporate finance, consolidated statements weave together the threads of multiple entities, revealing the true pattern of an organization's financial fabric."

Anon

How to Consolidate Financial Statements for Multiple Entities?

Step-by-Step Process for Consolidation

- Identify all entities to be included in the consolidation

- Gather individual financial statements from each entity

- Standardize accounting policies across all entities to ensure that financial statements are prepared consistently for group reporting.

- Identify and eliminate intercompany transactions

- Adjust for fair value and goodwill (if applicable) included in the consolidated financials.

- Calculate and record non-controlling interests

- Prepare consolidated financial statements

- Review and validate the consolidated reports to ensure they reflect the true financial position of the group.

Identifying Subsidiaries and Parent Company

To begin the consolidation process, you must first identify the parent company and all its subsidiaries. A subsidiary is typically defined as an entity in which the parent company holds more than 50% of the voting rights or has the power to control its financial and operating policies.

Utilizing Accounting Software for Consolidation

Modern consolidation software can significantly streamline the process of financial data aggregation and reporting. These tools often include features such as:

- Automated data collection from multiple sources

- Standardized chart of accounts

- Built-in elimination entries

- Enhancing currency translation capabilities is essential for effective financial reporting in multinational corporations.

- Audit trail functionality

What are the Reporting Requirements for Consolidated Financial Statements?

Understanding Compliance with Accounting Standards

Consolidated financial statements must comply with relevant accounting standards, such as International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP). These standards provide guidelines on recognition, measurement, presentation, and disclosure of financial information.

Reporting Requirements for International Financial Reporting Standards

IFRS 10 specifically addresses consolidated financial statements and outlines the principles for presenting and preparing these reports. Key requirements include:

- Consistent accounting policies across the group

- Elimination of intragroup transactions and balances to present an accurate picture of the financial results.

- Proper treatment of non-controlling interests in the context of consolidated to unconsolidated financial statements.

- Disclosure of the nature and extent of significant restrictions on access to assets and liabilities is required for public companies to ensure that financial statements are prepared transparently.

Documentation Needed for Compliance

To ensure compliance, organizations should maintain documentation of controlling interest and intercompany transactions.

- A group-wide accounting manual that incorporates exchange rate considerations.

- Detailed records of all intercompany transactions

- Documentation of elimination entries and consolidation adjustments is essential for accurate financial results.

- Supporting schedules for complex accounting areas (e.g., goodwill, fair value adjustments) to aid in preparing accurate consolidated financial statements.

- Audit trails for all consolidation processes

What is the Role of Elimination in Consolidated Financial Reporting?

Understanding Intercompany Transactions

Intercompany transactions are economic activities that occur between legal entities within the same group. These can include financial instruments and other transactions between legal entities.

- Sales and purchases of goods or services

- Loans and interest payments

- Dividends

- Asset transfers

Elimination of Unrealized Profits

When consolidating financial statements, it’s crucial to eliminate unrealized profits resulting from intercompany transactions to reflect the true financials. This ensures that the consolidated statements reflect only profits earned from transactions with external parties, thereby enhancing the integrity of the financial performance and position.

Impact of Elimination on Financial Performance

Elimination entries can significantly impact the consolidated financial statements by:

- Reducing reported revenue and expenses

- Affecting asset and liability balances

- Altering key financial ratios and performance indicators can distort the financial picture presented in the consolidated reports.

How to Prepare Consolidated Financial Statements?

Gathering Financial Data from Multiple Entities

To prepare consolidated financial statements, you’ll need to utilize financial consolidation software.

- Collect individual financial statements from all entities

- Ensure all statements are prepared using consistent accounting policies

- Translate foreign currency statements to the presentation currency

- Reconcile intercompany balances and transactions

Creating Cash Flow Statements for the Consolidated Group

The consolidated cash flow statement should:

- Combine cash flows from all entities

- Eliminate intercompany cash transactions

- Adjust for non-cash items resulting from consolidation (e.g., unrealized foreign exchange gains/losses)

- Present cash flows by operating, investing, and financing activities included in the consolidated financial statements.

Accounting Policies for Consolidation

Develop and implement group-wide accounting policies and practices that address:

- Revenue recognition

- Inventory valuation in accordance with multi-currency accounting policies.

- Fixed asset depreciation should be aligned across entities to avoid discrepancies in the group’s financial performance and position.

- Lease accounting

- Financial instruments play a crucial role in the consolidation of financial statements.

- Provisions and contingent liabilities

- Segment reporting

- Related party disclosures

What are the Benefits of Consolidated Financial Statements?

Improved Financial Health Insights

Consolidated financial statements provide an accurate picture of the group’s overall financial results, reflecting both consolidated and unconsolidated financial statements.

- A holistic view of the group’s financial position is necessary for public companies to attract investors and meet their reporting needs.

- Insights into the overall liquidity and solvency of the organization can significantly impact the group’s financial performance and position.

- Better understanding of the group’s capital structure and financing needs

Enhanced Financial Performance Evaluation

With consolidated statements, stakeholders can:

- Assess the group’s overall profitability and efficiency

- Compare performance across different segments or geographic regions

- Identify trends and patterns in the group’s financial performance over time to inform consolidation of financial strategies and avoid distorting the financial results.

Streamlined Financial Management

Consolidated reporting enables:

- More efficient allocation of resources across the group

- Improved risk management and internal control are essential for ensuring that the company may effectively navigate financial challenges.

- Better-informed strategic decision-making at the group level

Multi-Group Mastery

Consolidated financial statements are a crucial tool for multi-entity organizations to present a comprehensive view of their financial position and performance. By following the steps outlined in this guide and adhering to relevant accounting standards, you can create accurate and compliant consolidated reports that provide valuable insights for stakeholders and support informed decision-making. Remember that consolidation is an ongoing process that requires consistent application of accounting policies, regular review of group structures, and continuous improvement of reporting processes. With the right approach and tools, consolidated financial reporting can become a powerful asset for your organization’s financial management and strategic planning.

Your next steps...

💡Click here to ensure data residency compliance and reduce time spent on period-end reporting

🔋Click here if you wish to solve 25+ Spreadsheet reporting issues

🔆 Click here to improve the accuracy and usability of generated reports

💯 Click here to decrease risk by providing on-demand access to the transaction detail behind every reported balance

☎️ Book a free, no-obligation walkthrough with Mondial to see how we can help you in financial reporting and consolidations just like one of our successful clients.