SAP BUSINESS ONE EMPOWERS BUSINESSES

However, a hidden hurdle can emerge for enterprises with multiple subsidiaries – consolidation challenges that aren’t natively handled in SAP Business One.

In fact, there are several.

A need to drill down to transaction-level data because balances don’t provide the required level of information | The use of spreadsheets to make final adjustments – such as statutory reallocations, intercompany eliminations, or currency revaluations – not easy to make in the ERP system |

Central Repository of all Accounting Transactions | Group auditors often have very little direct access or visibility into the transaction history of remote subsidiaries. While balance detail may be considered sufficient in some cases when reporting, having access to the actual transaction data provides an additional level of corporate security. |

Groupwide GL Reporting Chart of Accounts | Group-level controllers often have to contend with group companies using disparate charts of account. This presents difficulty when reporting as different account structures have to be mapped accurately in order to produce accurate financial statements. |

Multi-Currency Reporting Transactions | Sometimes, overseas subsidiaries can only store data in their own operating currency, and so reporting in the currency of the parent presents challenges. Often times junior accounting staff spend hours or days manually translating local transactions into accurate reporting currency figures in spreadsheets. |

GAAP-Compliant Consolidated Reporting | When reporting in different countries, or to different authorities, different accounting treatments are often required for the same transaction or account. Corporate controllers often need to use spreadsheets to track the adjustments required to produce accounts in multiple GAAP formats. |

Cross Company Reporting Templates | Reports created in one company often have to be manually replicated in each company that wishes to use the same layout. Business Analyst or ERP Support staff often spend many hours configuring and reconfiguring reports for each subsidiary operation. |

Charts of accounts that are misaligned and different from each other | Operations across the group in different base currencies |

Calendar periods that differ in structure | Financial year ends that are not common to all companies |

The need to produce reports using both IFRS and local-GAAP | A need to revalue accounts in the currency of a parent company |

The use of multiple ERP systems, different versions of the same ERP system, or ERP systems hosted in multiple locations | A need to report in real-time |

This presents a strategic opportunity for you to unlock significant value for your clients.

By offering complementary solutions that address these consolidation shortcomings, you can position yourselves as trusted advisors who can streamline the consolidation process across multiple entities.

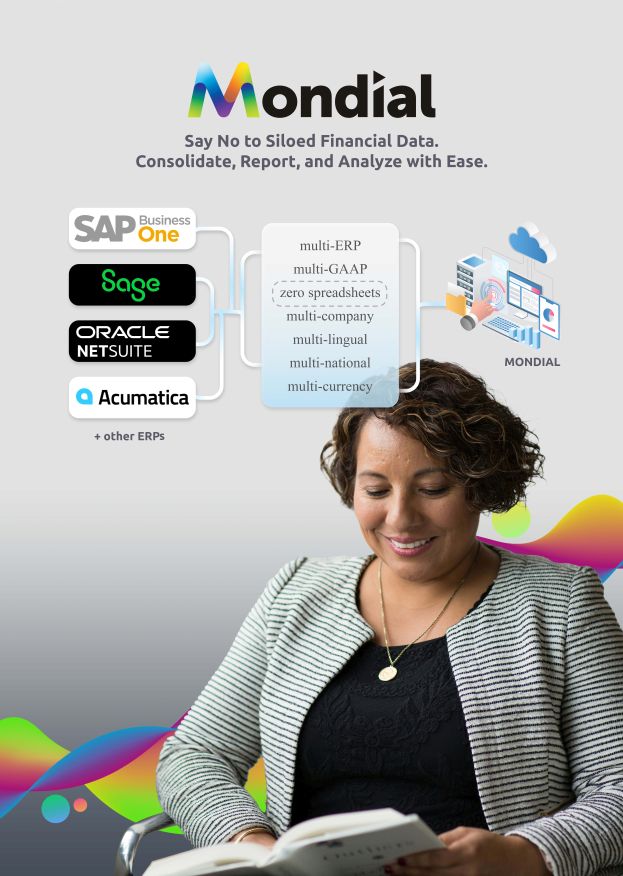

We’d like to invite your customers to a Free Webinar to witness how Mondial can be of help.

SIGN UP AND WE’LL SEND AN INVITE!

Help your Customers Fix their Financial Reporting and Consolidations!